A modern home inventory app for insurance is your secret weapon for documenting everything you own. It's the best way to prove your losses and get a fair, fast settlement after a disaster. An app turns a massive chore into a straightforward process, giving you undeniable proof of ownership right when you need it most. This digital record is your best friend in a chaotic time.

Why a Digital Home Inventory Isn't Just a Good Idea; It's a Financial Necessity

Let's be real: creating a home inventory is one of those tasks that always gets pushed to the bottom of the to-do list. We trick ourselves into thinking we can remember everything we own. But that's a dangerous assumption.

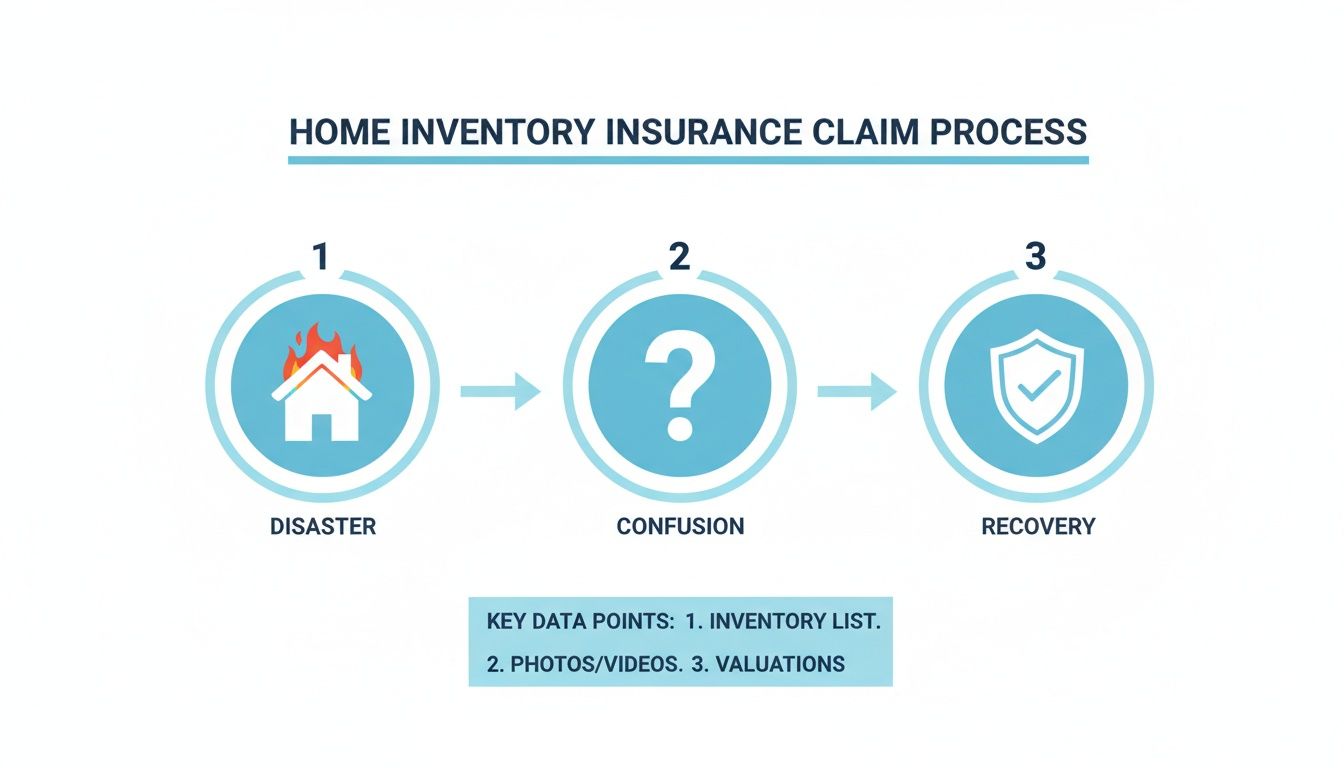

Imagine trying to list every single item in your living room from memory after something devastating like a fire or flood. Now imagine doing that for your entire house. It's basically impossible.

This is exactly where insurance claims can turn into a nightmare. Without detailed proof, an insurance adjuster has to take your word for it, which can lead to disputes, delays, and a much smaller payout than you actually deserve.

Get Beyond the Guesswork and Stress

A digital inventory completely removes the guesswork. It acts as your objective, detailed record of everything you have. Think of it as a pre-packaged claim file, ready to go at a moment's notice. Instead of struggling to recall the brand of your TV or the year you bought your couch, you have a searchable database with photos, receipts, and serial numbers at your fingertips.

An accurate home inventory isn't just an organizational tool; it's a critical piece of your financial preparedness. It can be the deciding factor between a smooth claims process and a long, frustrating battle for fair compensation.

Digital Proof is the New Standard

The shift to digital documentation isn't just a fad; it's a fundamental change in how we protect our assets. The market for home inventory apps has exploded, currently valued at around USD 1.39 billion and projected to hit USD 4.56 billion by 2032. This isn't just a random number, it shows a massive wave of homeowners realizing they need better ways to protect their stuff. You can see this trend detailed in recent industry analysis.

So, what's driving this surge? A few key things:

- Smartphones are everywhere, making it incredibly easy for anyone to snap photos and log items on the fly.

- There's a growing awareness about just how important it is to have solid proof of ownership.

- Unfortunately, property-related disasters are on the rise, making detailed records more essential than ever.

Taking the time to document your belongings is a core part of being ready for whatever life throws at you. For a deeper dive, check out our guide on how to prepare for natural disasters.

Your Game Plan for a Painless Home Inventory

The thought of cataloging every single thing you own can feel paralyzing. It's one of those projects that's so easy to put off because, honestly, where do you even begin? Most people get overwhelmed and quit before they even start.

But here’s the secret: this isn't a marathon weekend session. Forget trying to do it all at once. The real key is a smart, strategic approach that breaks the whole project down into bite-sized pieces. We're not aiming for perfection on day one; we're building a manageable workflow that creates a powerful asset for your family's financial security.

Start with the High-Value Zones

Instead of looking at your entire house and feeling defeated, just pick one room. Seriously, that's it. And the best place to start is wherever your most expensive items are clustered together. For a lot of us, that's the home office or the living room.

Think about where you have pricey electronics: the big-screen TV, the sound system, computers, or that new gaming console. These items are not cheap to replace, and they're often the first things an insurance adjuster will ask about. Knocking these out first gives you an immediate win and builds the momentum you need to keep going.

Once you’ve conquered that first room, move on to other high-value categories, especially those that might have specific coverage limits on your policy.

- Jewelry and Watches: These often need a separate rider or to be "scheduled" on your policy, so having detailed proof of ownership and value is non-negotiable.

- Art and Collectibles: This is the time to gather any appraisals or certificates of authenticity you have. Don't wait until after a disaster to realize they're missing.

- Major Appliances: Your refrigerator, washer, dryer, and oven are huge investments. Get them documented early.

Gather Your Proof Before You Start Snapping Photos

Here's a pro tip that will save you a ton of backtracking: gather your documents before you start taking pictures. Dig out any receipts, warranties, and professional appraisals you can find. A quality home inventory app for insurance will let you scan and attach these digital files directly to each item's entry. This creates an ironclad, verifiable record that leaves no room for dispute.

If you're looking for the right tool for the job, you can explore different types of home inventory software to see what fits your needs best.

This isn't just busywork; it's about building a clear, simple path to recovery if the worst happens.

As you can see, a prepared inventory acts as your shield, turning a chaotic and emotionally draining situation into a structured, straightforward, and much faster recovery process.

The goal is progress, not perfection. Cataloging just one room is a huge win. Tackling your inventory in small, consistent sessions is far more effective than trying to do it all at once and burning out.

Documenting Your Belongings Like a Pro

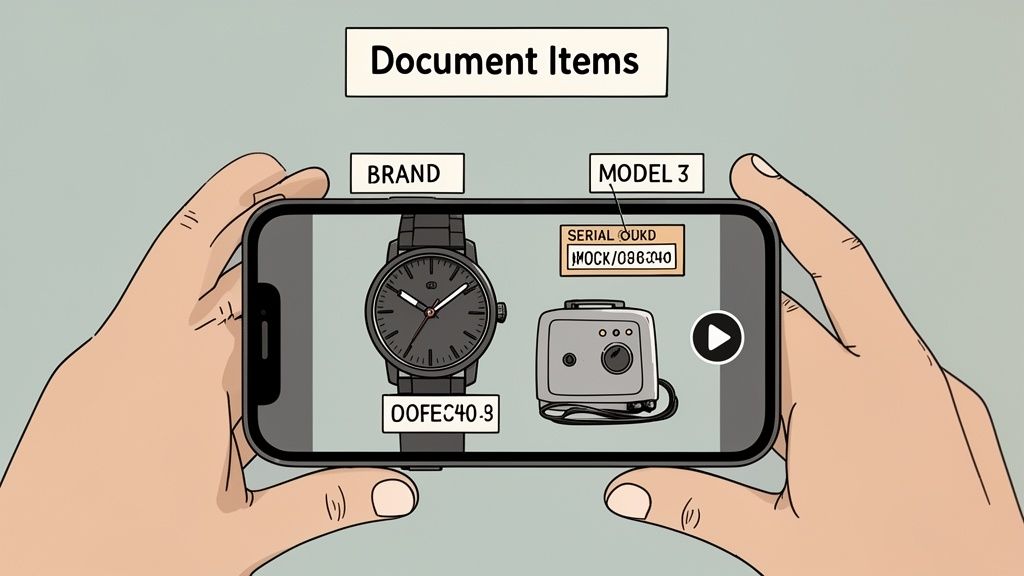

Let's get down to the nitty-gritty. When you have to file an insurance claim, fuzzy descriptions like "a brown couch" or "a flatscreen TV" just won't fly. An adjuster needs specifics, and the quality of your documentation directly impacts the speed and success of your claim.

Think of every entry in your home inventory app for insurance as a piece of undeniable proof. This is where your smartphone becomes your most valuable tool, turning what sounds like a chore into a surprisingly quick process. The goal here is clarity and detail, enough to leave zero room for doubt.

Mastering the Art of Visual Documentation

Your first pass through any room should be all about the visuals. Nothing tells the story of what you own, and its pre-loss condition, better than a combination of photos and video.

When you're photographing individual items, especially electronics, appliances, or anything of value, you need to think like a detective. A single wide shot isn't enough.

- Get the whole picture: Start with one clear photo showing the entire item in its usual spot.

- Zoom in on the essentials: Now, get close. Take separate, focused pictures of any brand names, model numbers, and most importantly, serial numbers. These are usually on little tags or plates on the back or bottom of an item.

- Capture the quirks: Don't forget to document any unique features, for example a distinctive scratch on a wooden table or a specific pattern on a collectible vase. These details are surprisingly powerful for proving ownership.

A video walkthrough complements the photos perfectly. Just hit record on your phone and slowly walk through each room. Pan across the space, open closet doors and cabinets, and even narrate what you're seeing. This creates an incredible record of the sheer volume of your belongings and their general state.

Let Your App Do the Heavy Lifting

This is where a modern inventory app really shines. The days of manually typing out every single detail are over. Many of the best apps now use image recognition to identify what you just photographed, automatically suggesting categories and sometimes even pulling the exact product details from online databases.

Honestly, this feature is a game-changer. It saves a staggering amount of time. Instead of typing "Samsung 55-inch Class QN90C NEO QLED 4K Smart TV," you can often just snap a clean picture of the model number, and the app fills in the rest. It transforms a tedious task into a quick, satisfying check-off.

The single most important element of a rock-solid insurance claim is your proof of purchase. Attaching digitized receipts directly to each item's entry is your best defense against valuation disputes.

Digitizing Your Proof of Purchase

Visuals prove you owned something. Receipts prove what it was worth. A good app makes managing this ridiculously simple.

- Scan your paper trail: Use your phone’s camera to snap photos of old paper receipts. Many apps have built-in scanners that can even read the text, making the details searchable later.

- Forward your e-receipts: For all your online purchases, just forward the confirmation email to a special address provided by your app. It will automatically parse the information, create a new inventory entry, and attach the email as proof.

Building this searchable database of purchases is probably the most powerful step you can take. Imagine an adjuster asking for proof of value for 25 different items. Instead of a frantic, week-long search through shoeboxes and old emails, you can generate a detailed report in seconds, complete with photos and attached receipts for every single thing. That level of organization doesn't just make your life easier; it tells your insurance company you mean business.

Valuing Your Items and Creating Insurer-Ready Reports

You’ve done the hard work of photographing your belongings and scanning your receipts. That's a huge step, but for an insurance adjuster, it only answers half the question. The next, equally critical part is figuring out what everything is actually worth.

This is where many homeowners get tripped up. Assigning a value is an essential part of building a successful claim. Without accurate numbers, even the most detailed photo library can lead to a settlement that falls short of what you truly need to recover. The goal here is to transform your simple list of items into a comprehensive, professional report that an adjuster can process without a headache.

Understanding Key Insurance Valuations

Before you start plugging in numbers, you need to get familiar with two very important terms that live in your insurance policy: Actual Cash Value (ACV) and Replacement Cost Value (RCV). Your policy almost certainly uses one of these to figure out your payout, and the difference is massive.

- Actual Cash Value (ACV) is what your item was worth the moment before it was lost or damaged. Think of it as the "garage sale" price. It accounts for depreciation, so your five-year-old laptop isn’t valued at what you paid for it, but at what a similar used one would cost today.

- Replacement Cost Value (RCV) is the cost to buy a brand new, similar item today. This coverage usually costs a bit more, but it provides a much larger payout. It allows you to replace your old belongings with new ones without having to cover the difference yourself.

Pull out your policy’s declarations page to see which type of coverage you have. Knowing this upfront will guide how you research and assign values in your inventory app, making sure your final report lines up perfectly with how your insurer operates.

Researching and Assigning Accurate Values

For everyday stuff like your sofa or that TV in the living room, a quick search on retail sites or online marketplaces can give you a solid ballpark figure for either ACV or RCV. Just look for items of a similar brand, model, and condition to land on a realistic estimate.

But when it comes to specialized or high-value possessions, you need to be much more precise.

The most powerful insurer-ready reports are backed by objective, verifiable data. For unique items, this means going beyond a simple guess and providing third-party validation of their worth.

Take high-end watches, for example. Performing a detailed watch serial number lookup can verify authenticity and establish its market value, which is exactly the kind of proof an adjuster loves to see. Similarly, antiques, art, and rare collectibles almost always require a formal appraisal to pin down their true worth. You can scan and attach these appraisal documents directly to the item's entry in your app.

Juggling all this paperwork is a lot easier with a good system. You might find our guide on how to keep track of receipts helpful for that.

Generating a Report That Gets Your Claim Approved

At the end of the day, the whole point of your home inventory is to generate a clean, detailed, and undeniable report for your insurer. A well-organized report speaks volumes to an adjuster; it shows you're prepared and serious, which can dramatically speed up the entire process.

This kind of digital proof is quickly becoming the standard. In fact, 37% of household insurance claims in the United States now include digital inventory documentation. The result? An average 19% reduction in claim processing times. You can see more data on this trend over at the Market Growth Reports website.

Your final report should be a crisp, itemized PDF that includes:

- A clear photo of each item.

- A detailed description, including brand and model number.

- The assigned value (ACV or RCV) and the date you determined it.

- A scanned copy of the original receipt or appraisal.

- A grand total summarizing the value of all items in the claim.

This complete package removes any guesswork, minimizes the back-and-forth emails, and gives the adjuster everything they need to approve your claim fairly and quickly.

Keeping Your Inventory Secure and Up to Date

Getting your initial home inventory done is a huge win, but it’s not a "one and done" project. The best way to think of your inventory is as a living document, something that grows and changes right along with your life. The real key is keeping it current without letting the updates become another massive chore you keep putting off.

The easiest strategy I've found is to build a simple, repeatable routine. A quick check-in just twice a year can make all the difference. This isn't about re-doing the whole house; it's just about managing the comings and goings.

Pop a recurring reminder in your calendar for every six months. When it goes off, just take a few minutes to add any big new purchases, for example that new 4K TV, the stand mixer, or that piece of art you finally bought. While you're at it, archive or delete the items you've sold or donated. This little habit keeps your records sharp and stops the task from ever feeling overwhelming again.

Your Inventory Is Only as Good as Its Backup

Let's be blunt: security is the most important part of this entire process. An incredibly detailed inventory is completely worthless if it's stored on a laptop that gets fried in the same fire you're trying to protect yourself from. This is precisely why cloud-based storage is non-negotiable for any modern home inventory app for insurance.

When your data lives securely online, it’s completely separate from your physical home and your devices. If the worst happens, you can pull up your complete, detailed records from any phone or computer, anywhere in the world. This off-site backup is your ultimate safety net, the one thing that guarantees you have the proof you need when it matters most.

Your home inventory contains a wealth of personal data. Choosing an app with robust security features, including encryption, ensures your information is protected from unauthorized access while remaining available to you after a disaster.

Safely Sharing Your Data When It Counts

When it's time to actually file a claim, the last thing you need is a clunky or insecure way to share your hard work. Any quality app should make this part simple and safe. Look for features that let you generate a secure, read-only link or a password-protected PDF report.

This gives your insurance agent or public adjuster all the information they need without you having to hand over the keys to your entire account. You can typically control their permissions, making sure they can view the necessary details without being able to edit or delete anything. That's how you keep your private information protected while still moving the claims process forward.

Even with the best precautions like regular backups, digital data can sometimes be lost or corrupted. In such unforeseen circumstances, exploring reliable data recovery solutions can be crucial for retrieving your valuable home inventory information, ensuring your records remain complete for insurance purposes.

Common Questions About Home Inventory Apps

Even with the best app in hand, it's natural to have a few questions pop up. That’s perfectly normal. Getting straight answers is the key to feeling confident that the work you're putting in now will actually pay off when you need it most.

Let's walk through some of the most common questions homeowners ask when they start building a digital inventory for their insurance needs.

How Often Should I Update My Inventory?

This is a big one, and the answer is simpler than you might think. While a full, top-to-bottom review once a year is a solid baseline, the real secret is to treat it like a living document. The "as-you-go" method is way less intimidating and much more effective.

Just bought a new laptop, a sofa, or that fancy exercise bike you’ve been eyeing? Take five minutes to add it to your app right then and there. Snap a photo, forward the e-receipt from your inbox, and you're done. This small habit prevents the task from snowballing into a massive project you'll keep putting off.

Pro Tip: I always tell people to schedule a quick inventory check-in after any major life event. A renovation, a big holiday season, inheriting furniture from a relative, or even just a move are all perfect triggers to make sure your records are 100% accurate.

How Do I Document Antiques, Collectibles, and Other Special Items?

So, what about the things that don't have a simple price tag from a big-box store? For your truly special possessions like art, family heirlooms, antiques, or valuable collectibles, you need to go a step beyond a basic photo.

Detailed pictures of any unique markings, signatures, or damage are crucial, but the gold standard here is a formal appraisal from a certified professional. Nothing beats it. This gives you objective, third-party proof of value that is incredibly powerful when you're negotiating a claim.

- Scan the appraisal: Get a high-quality digital copy of the official document.

- Attach it directly: Link that scanned file right to the item's entry in your app.

- Update periodically: For items that might appreciate in value, like art or certain collectibles, think about getting an updated appraisal every 3-5 years.

This extra step transforms a subjective valuation ("my grandmother's priceless vase") into an undeniable financial fact that an insurance adjuster can't easily dispute.

Can I Use My Inventory for Anything Besides Insurance?

Absolutely! While its main job is to protect you in a disaster, a detailed digital inventory is a fantastic tool for general life organization. You’ll be surprised how often you turn to it.

People use their inventory for all sorts of things:

- Estate planning: It creates a clear, shareable record of assets that makes things much easier for your family down the road.

- Moving: It’s the perfect checklist to make sure nothing gets lost or left behind in transit.

- Warranty tracking: You'll always know exactly where to find purchase dates and model numbers for repairs.

- General organization: It finally answers the question, "What did I put in that box in the attic?" or helps you remember who you lent your power tools to.

Ultimately, a good home inventory app for insurance gives you a complete, searchable picture of everything you own. That’s a powerful asset in more ways than one.

Ready to stop worrying and start organizing? Vorby uses AI-powered tools to make documenting your home simple, fast, and secure. Generate insurer-ready reports, track warranties, and find anything in your house with a quick search. Start your free 14-day trial and build a complete inventory today at https://vorby.com.