A detailed house inventory for insurance isn't just a list; it's a comprehensive record of your personal belongings, complete with photos, descriptions, and what they're worth. Think of it as undeniable proof for your insurance provider, making sure you can claim the full value of everything you own after a fire, theft, or natural disaster. Without it, you’re left scrambling to remember every last thing during an incredibly stressful time, a situation that can easily cost you thousands.

Why a Home Inventory Is Your Strongest Financial Shield

When disaster strikes, the last thing you want is a financial battle piled on top of an emotional one. A detailed house inventory is your most powerful tool in the claims process, turning a vague memory into concrete evidence.

Insurers require proof of ownership and value. Simply saying you owned a laptop isn't going to cut it. You need to prove you owned a specific model, its condition, and its worth. This is where so many people lose out.

Many homeowners and renters leave thousands of dollars on the table by relying on memory alone. After a catastrophic event, it's nearly impossible to recall every single item you owned. We tend to focus on the big-ticket things like furniture and electronics, but the combined value of all the smaller stuff adds up shockingly fast.

The True Cost of Forgetting

Just think about your kitchen cabinets, your closets, and your bookshelves for a moment. The cost to replace every single pot, pan, shirt, and book can be staggering. An inventory captures all those details, ensuring you account for everything. And this isn't just about big disasters; it’s equally critical for smaller claims, like a burglary where specific electronics or jewelry are stolen.

The hard truth is that most people are completely unprepared. According to a 2023 survey, a staggering 53% of homeowners have never created an inventory of their possessions, leaving them financially exposed. This reveals a massive gap between risk and readiness, a gap that a simple inventory can close. You can see more stats on homeowner preparedness on the Triple-I's website.

A home inventory is not a simple checklist. It is a critical piece of financial protection, a pre-packaged claim file ready to go when you need it most. It shifts the power back to you during the claims process.

Digital vs. Manual Inventory Methods at a Glance

Choosing how to create your inventory is the first step. While a simple notebook might seem easy, modern digital tools offer speed, security, and claim-readiness that old-school methods just can't match. Here’s a quick breakdown.

| Feature | Digital Inventory Apps | Manual Methods (Spreadsheet/Notebook) |

|---|---|---|

| Speed & Efficiency | Fast photo/video capture; often has barcode scanning and AI item recognition. | Slow, manual data entry for every single item. |

| Data Security | Secure, cloud-based storage with encryption and backups. | Vulnerable to physical loss (fire, theft) or data corruption. |

| Claim-Readiness | Can generate detailed PDF/CSV reports instantly for adjusters. | Requires manual compilation and organization during a crisis. |

| Accessibility | Accessible from any device, anywhere, anytime. | Only accessible if you have the physical copy or specific file. |

| Updating | Easy to add new items as you buy them; simple to edit entries. | Cumbersome to update; requires finding the right line or page. |

While any inventory is better than none, using a dedicated app turns a tedious chore into a streamlined, effective process that truly protects you.

Protecting Your Claim from Denial

An incomplete or unsubstantiated claim is an easy target for delays or even outright denial. By understanding the potential hurdles ahead of time, you can build a rock-solid case for reimbursement. It's smart to be aware of common insurance claim denial reasons so you can ensure your inventory effectively counters them. Your documentation preemptively answers the very questions an adjuster will ask, making the whole process smoother and faster.

As climate-related risks continue to grow, the likelihood of needing to file a claim is higher than ever. A thorough inventory is no longer a "nice-to-have," it's a fundamental part of responsible homeownership and renting. For more practical advice on getting started, you can check out our guide on taking an inventory. This small investment of time provides immense peace of mind, ensuring you can rebuild your life without a preventable financial struggle.

Looking at the task of documenting every single thing you own can be paralyzing. It's the kind of project that's so massive, it’s easy to put off forever, or worse, give up minutes after you start. But the secret to creating a solid house inventory for insurance isn't doing it all at once. It's about breaking it down.

The best strategy I've seen, and the one that actually works, is going room by room. This simple shift in perspective turns an overwhelming marathon into a series of small, manageable sprints. When you focus on just one space at a time, you build momentum. Seeing your progress is a huge motivator that keeps you going.

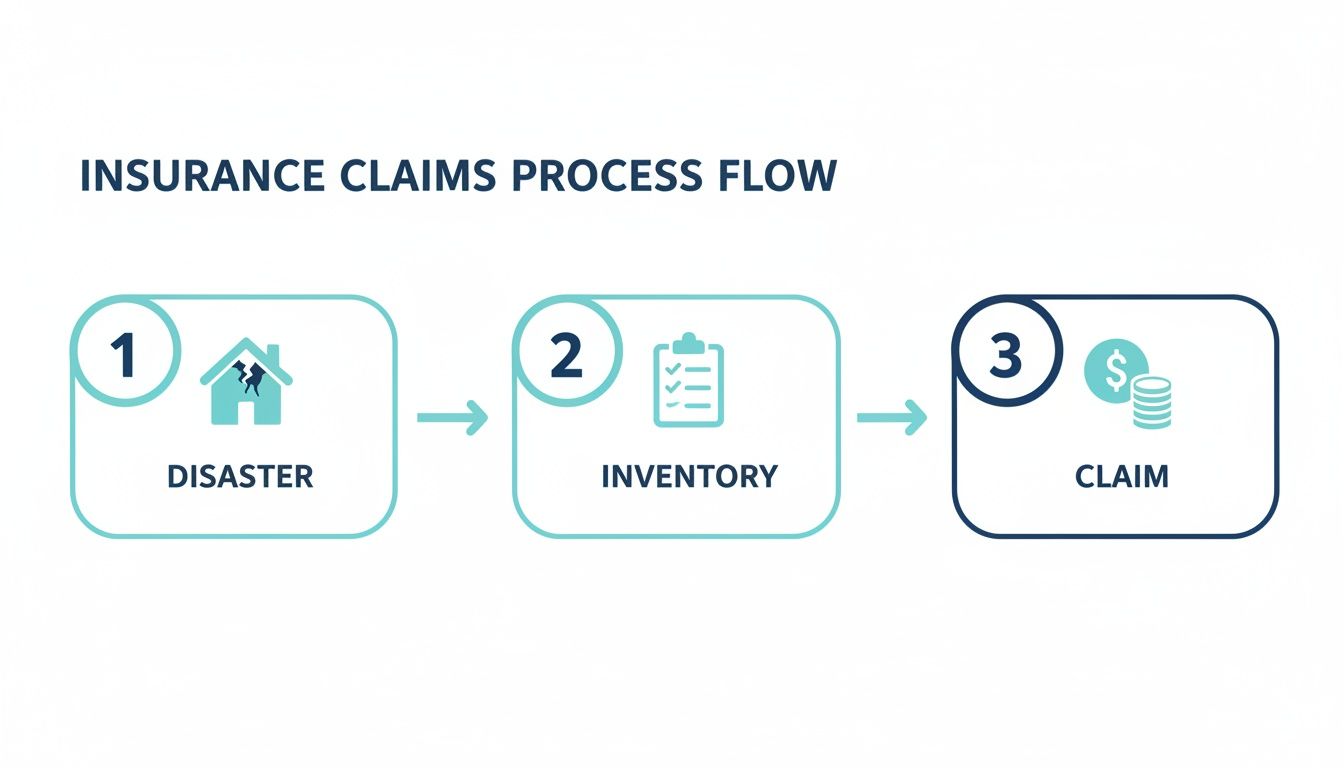

This simple flow chart really drives home why this matters. A prepared inventory is the critical link between disaster striking and you getting a fair settlement from your insurance company.

Without that middle piece, the whole claims process can fall apart, leaving you scrambling to prove what you lost from memory alone.

Where to Begin Your Inventory Journey

So, where do you start? My advice is to pick an area that gives you an easy win. Go for a high-value or well-organized spot first, like your home office or the entertainment center. These spaces are usually packed with expensive electronics that have clear makes, models, and serial numbers, making them pretty straightforward to document.

Getting one important room completely logged gives you a huge psychological boost. You get a tangible victory right away and a repeatable process you can use for the rest of the house. You’ll quickly find a rhythm: snap photos, jot down the details, and move to the next item.

For instance, in your home office, you’d focus on:

- Electronics: Your computer, monitor(s), printer, speakers, and any external hard drives.

- Furniture: The desk, your ergonomic chair, and the bookshelves.

- Office Supplies: You don't need to list every single pen, but a quick photo of your supply drawer is a smart move.

Checklists for Key Living Areas

As you move through your home, a simple checklist for each room will keep you on track. The goal here isn't perfection on the first try; it's about being thorough. You can always circle back to add more detail later.

Living Room & Family Room

- Furniture: Sofas, armchairs, coffee and end tables, and any area rugs.

- Entertainment: The TV, sound system, streaming devices, and gaming consoles.

- Decor: All the artwork, lamps, curtains, and even the throw pillows. Don't skip the small decorative objects, they add up fast.

Kitchen & Dining Room

- Major Appliances: Refrigerator, stove, oven, dishwasher, and microwave.

- Small Appliances: Coffee maker, blender, toaster, stand mixer, and so on.

- Cookware & Tableware: Pots, pans, dishes, silverware, and glassware. It’s fine to group these (e.g., “12-piece Crate & Barrel dinnerware set”).

Pro Tip: Tackle your inventory in 30-minute bursts to keep it from feeling like a chore. Set a timer, focus on one small area like a closet or a single cabinet, and stop when it goes off. You'd be surprised how fast those consistent, small efforts add up to a completed inventory.

Efficiently Grouping Similar Items

You absolutely do not need a separate entry for every single book, Blu-ray, or piece of clothing. For large collections, a group approach is far more efficient and just as effective for insurance purposes.

Take a clear video panning across your entire bookshelf, or snap a few photos that show the spines of all the books. Then, you can create a single entry like "Approximately 200 paperback and hardcover books" with an estimated total value. The only exception? If you have particularly valuable first editions or signed copies, document those individually. This method saves a ton of time while still giving your insurer the proof they need.

Don't Forget the Forgotten Spaces

Some of your most valuable, and most easily forgotten, items are tucked away in the places you rarely go. It's crucial to dedicate specific inventory sessions to these often-overlooked areas.

- Garage: This is a goldmine for expensive items. Think power tools, lawn equipment, bicycles, and sporting goods. A high-end lawnmower alone can be worth thousands.

- Basement & Attic: These spaces often hold seasonal decorations, stored furniture, luggage sets, and priceless family heirlooms. That box of old family photos or your grandmother's china has both sentimental and replacement value.

By methodically working your way through every room, closet, and storage zone, you'll build a complete and accurate record of your belongings. A well-organized list is your best friend in a crisis, which is why we created a home inventory list template to help structure your efforts and make sure nothing gets missed.

Your Smartphone is Your Best Friend for Proving What You Own

When you’re staring down the barrel of an insurance claim, a spreadsheet listing your stuff is a decent start. But visual proof? That’s the knockout punch. A picture isn't just worth a thousand words; it can be worth thousands of dollars when you're trying to get a fair settlement.

Honestly, this is one of the most critical parts of building your house inventory for insurance.

Your phone is the only tool you need to create powerful, undeniable evidence of your possessions. Photos and videos give your list a layer of context and verification that an adjuster simply can't argue with. They prove not only that you owned something but also show its condition right before disaster struck.

This visual record is your best defense against the soul-crushing task of remembering and justifying every single item from a traumatized memory. It's a real problem. After some of the devastating California wildfires, the process of itemizing losses became so mentally taxing that lawmakers actually proposed forcing insurers to pay out policy limits without a list because the task was just compounding the trauma for survivors.

The Best Approach: A Mix of Photos and Videos

So, which should you use, photos or video? My answer is always: both. Each one has a specific job to do, and using them together creates a rock-solid record of your belongings.

- Videos for the Big Picture: A walkthrough video is perfect for showing the overall context of a room. You can sweep across the space and capture the general layout and sheer quantity of items in a way static photos sometimes miss.

- Photos for the Critical Details: This is where you zoom in on what makes an item valuable. Still photos let you capture brand names, serial numbers, and specific features without dealing with a shaky camera or blurry footage.

This hybrid strategy gives you broad proof of everything you own and specific, detailed proof for your most valuable things.

How to Take Photos an Insurance Adjuster Will Love

This isn't just about pointing and shooting. You need to think like an insurance adjuster. What information would they need to approve your claim without a dozen follow-up questions?

For every room, follow this simple two-step process:

- The Wide Shots: First, stand in a few different corners of the room and take several photos of the entire space. This establishes the setting and shows all the big-ticket items in their natural habitat.

- The Close-Ups: Once you have the overview, it's time to zero in on individual high-value items. This is where the money is.

For your close-up shots, make sure you capture:

- Serial and Model Numbers: For any appliance, electronic, or power tool, this is the single most important piece of information you can get. It's non-negotiable proof.

- Brand Names and Logos: Get a clear shot of the manufacturer's name on furniture, TVs, speakers, and designer goods.

- Unique Features or Pre-existing Damage: Document the item's specific condition. For an antique, that might be a unique carving. For your laptop, a photo showing it's in pristine, scratch-free condition can make a big difference.

Expert Tip: Don't stop at what's visible. Open up your closets, cabinets, and drawers. A quick photo of a fully stocked linen closet or a drawer packed with silverware can represent hundreds, if not thousands, of dollars in replacement costs that are incredibly easy to forget in a crisis.

Using Video to Tell the Whole Story

Video adds a layer of authenticity that’s tough to replicate. Think of it as a guided tour for your insurance adjuster, where you can narrate what the camera is seeing.

You don’t need a fancy script; just speak naturally as you walk.

For instance, as you pan across your living room, you could say something like, "Okay, this is the living room. The couch and loveseat are from West Elm, bought in June 2022. And over here is our 75-inch Samsung Frame TV, model number QN75LS03B, which we got last Christmas." This verbal confirmation, paired with the clear visual, is incredibly compelling.

Remember to move slowly. Open closet doors. Pan across bookshelves. Swing open media cabinets to show the game consoles and sound systems inside. This continuous shot creates a complete and honest record, making your inventory both thorough and highly credible.

Documenting Value with Receipts and Appraisals

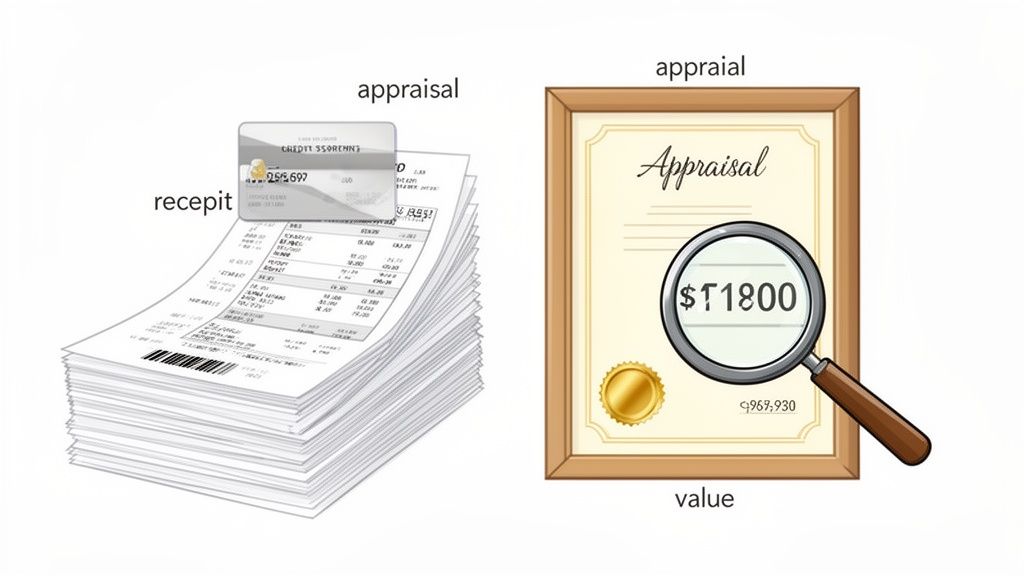

Visual evidence proves you owned something, but paperwork proves what it was worth. This is the step that separates a basic home inventory from an ironclad insurance claim that gets you the full settlement you deserve.

Think about it: without financial documentation, you're leaving the valuation of your stolen or damaged belongings entirely up to your insurer's discretion. That’s a gamble you don’t want to take. Photos and videos set the stage, but receipts and appraisals are your closing argument. They provide concrete, third-party proof of an item's value, shutting down any guesswork or disputes.

Gathering Your Financial Proof

Okay, it's time to play detective and hunt down any proof of purchase you can find. It might sound tedious, but even a few key documents can substantiate thousands of dollars in value. Don't feel pressured to find everything, just start with your most valuable possessions first.

Here's what you should be looking for:

- Original Sales Receipts: This is the gold standard. Snap a clear photo or use a scanning app to digitize them, then attach the file directly to the item in your inventory.

- Credit Card Statements: Can't find the receipt? A credit card statement showing the store, date, and purchase amount is the next best thing.

- Bank Statements: Just like credit card statements, these can verify major purchases and serve as solid evidence.

- Email Confirmations: Don't forget the digital trail! Search your email for order confirmations from places like Amazon, Wayfair, or Best Buy. These are just as valid as paper receipts.

If managing all this paper feels like a huge hassle, you're not alone. Our guide on how to keep track of receipts has some great strategies for wrangling both physical and digital proof of purchase.

When to Bring in a Professional Appraiser

Some of your most prized possessions simply don't have a price tag from a big-box store. For unique, rare, or high-value items, getting a professional appraisal isn't just a good idea, it's non-negotiable. An appraisal provides an expert, defensible valuation that an insurance company has to respect.

You should absolutely get a formal appraisal for:

- Fine jewelry and engagement rings

- Antiques and fine art

- Collectibles (like rare coins, stamps, or memorabilia)

- High-end musical instruments

- Family heirlooms with significant monetary value

An appraisal doesn't just establish an item's current market worth; your insurer may actually require one to properly cover the item with a special policy rider or floater.

Actual Cash Value vs. Replacement Cost Value

Knowing your stuff is only half the battle; you also need to know your policy. Two little acronyms, ACV and RCV, can make a difference of thousands of dollars when it's time to file a claim.

- Actual Cash Value (ACV): This is what your item is worth today, with depreciation factored in. If your five-year-old laptop gets fried, an ACV policy only pays you what a used, five-year-old laptop is worth. Spoiler: it’s not enough to buy a new one.

- Replacement Cost Value (RCV): This is what you really want. RCV pays you the full cost to replace your destroyed item with a brand new, similar one at today's prices. No deduction for depreciation.

Know Your Policy. The difference between ACV and RCV is critical. It shapes how you document value and sets your expectations for what you’ll get back. If you have the choice, always go for an RCV policy.

The global home insurance market is exploding for a reason. In 2023, it hit USD 271.9 billion and is projected to reach a staggering USD 576 billion by 2033. Insurers are relying more than ever on detailed inventories like yours to process claims accurately, making your documentation efforts absolutely essential.

How to Keep Your Inventory Safe and Up to Date

Let’s be honest: creating a thorough house inventory for insurance is a huge task. You’ve put in the hours, and now it’s done. But all that work is completely worthless if two things aren’t true: you can actually get to it after a disaster, and it reflects what you own right now. This last part is what turns your inventory from a one-time project into a living document that truly has your back.

The single biggest mistake I see people make is saving their only copy on a home computer or a lone external hard drive. Think about it. If a fire, flood, or major theft hits your home, where is that computer? It’s gone, along with your proof of ownership, right when you need it most. Safe, off-site storage isn’t just a good idea; it's non-negotiable.

Smart and Secure Storage Solutions

Your goal is simple: store your inventory somewhere physically separate from your house. Thankfully, this is easier than ever, and you have some fantastic options that will make sure your data survives even if your devices don't.

Here are the methods I always recommend:

- Cloud Storage Services: This is the go-to for most people, and for good reason. Services like Google Drive, Dropbox, or iCloud are practically set-it-and-forget-it. Your files sync automatically, and as long as you can get online from any phone or computer, your inventory is right there waiting for you.

- Encrypted Inventory Apps: If you're using a dedicated app like Vorby, you're already a step ahead. These services are built for this exact purpose, storing your data in the cloud with serious end-to-end encryption. You get both off-site safety and an extra layer of privacy for sensitive info.

- Emailing a Trusted Contact: This is a surprisingly effective low-tech solution. Just export your completed inventory (a PDF report with all the photos is perfect) and email it to a reliable friend or family member who lives in another town. Simply ask them to tuck it away in their email for you.

- Physical Safe Deposit Box: For those who prefer a tangible backup, save your entire inventory to a USB drive and stick it in a safe deposit box at your bank. The only catch? You have to remember to swap it out with an updated version at least once a year.

With the increasing frequency of climate-related disasters, the home insurance industry is under massive pressure. The market is projected to nearly double from USD 238.31 billion in 2023 to a staggering USD 476.68 billion by 2032. This means insurers are scrutinizing claims more closely than ever. Yet, a 2023 survey found that only 47% of homeowners have bothered to create an inventory. That's a huge gap in preparedness.

Creating a Simple Maintenance Schedule

Your inventory is a snapshot in time. As you buy a new laptop, sell an old couch, or receive a valuable gift, that picture gets outdated. A stale inventory can leave you underinsured, leading to major headaches and financial loss when you file a claim.

The good news is that keeping it current is way easier than creating it from scratch. All you need is a simple, recurring schedule to make sure your list stays accurate with minimal effort.

Key Takeaway: Treat your home inventory like your smoke detector batteries. A quick check-up twice a year and a more thorough review annually ensures it will work perfectly when you need it.

Beyond just documenting your belongings, some people add another layer of security. Hiring a professional security guard for home protection is a proactive step that can physically deter theft, complementing the financial protection your inventory provides.

Inventory Update and Review Schedule

To make this dead simple, here’s a practical schedule you can set up with calendar reminders. This turns a daunting task into a manageable routine, ensuring your inventory is always ready for action.

| Frequency | Tasks to Complete | Best Time to Do It |

|---|---|---|

| After Major Purchases | Immediately add any high-value items (new TV, appliance, jewelry). Snap a photo of the item and its receipt while it's fresh in your mind. | The same day you make the purchase or have it delivered. |

| Every 6 Months | Do a quick visual sweep of your home. Add any significant new items you've acquired and remove major things you've sold or gotten rid of. | Set a recurring calendar reminder, maybe for January and July. |

| Annually | Conduct a more thorough walkthrough. Go room by room with your inventory, update valuations for key items, and check that all your photos and documents are current. | A great time is during spring cleaning or around your insurance policy renewal date. |

By adopting these habits, secure storage and regular updates, you transform your inventory from a static checklist into a powerful, dynamic tool. This proactive mindset is what guarantees all your hard work pays off, leading to a smoother, faster, and fairer claims process if the unexpected happens.

Common Questions About Home Inventories

Even with the best plan, you're going to have questions pop up while you're cataloging your stuff. It’s totally normal. Getting the small details right can feel a little tricky, but a few quick answers can clear up the confusion that usually trips people up.

Think of this as your go-to guide for those "what if" scenarios. Getting this stuff right means your inventory will actually do its job when you need it most. It's about swapping that uncertainty for confidence.

How Detailed Does My Inventory Need to Be?

This is the big one, the question I hear most often. The answer is all about finding that sweet spot between being thorough and being practical. No, you don't need to list every single fork. But you absolutely need enough detail to prove you owned something and what it was worth.

A good rule of thumb: Document any individual item you would want to be specifically reimbursed for.

Here’s what that looks like in a real kitchen:

- Grouped Items: "12-piece Crate & Barrel dinnerware set, purchased 2022, approx. value $150." This is perfect for everyday things.

- Specific Items: "KitchenAid Artisan Series 5 Quart Stand Mixer, Model KSM150PSER, purchased 2023, receipt available, value $450." You need this level of detail for anything expensive.

The goal is simple: give an insurance adjuster enough info, brand, model number, purchase date, and value, so they can verify your claim without a dozen follow-up emails.

What Should I Do with Gifts or Inherited Items?

Things you were given are just as valuable as things you bought, but they come without that neat paper trail. This is exactly where your photos and videos become the most important part of your inventory. They are your undeniable proof of ownership and condition.

When it comes to figuring out their value, you have a couple of options:

- Research Comps: Hop online and see what a similar item (same brand, condition, and age) is selling for on places like eBay or dedicated antique marketplaces.

- Get a Formal Appraisal: For anything truly significant, like your grandmother’s diamond ring or a piece of antique furniture, an official appraisal is the only way to lock in a value that an insurance company will take seriously.

- Add Context: It doesn't hurt to add a note like, "Inherited from my aunt in 2020." It won't prove financial value, but it adds a layer of context to your claim.

Without a receipt, the game changes. The burden of proof is now on you to show what it would cost to replace that item today. Your research and visual evidence have to do all the talking.

Remember this: An insurance claim is a negotiation. The more detailed, organized, and verifiable evidence you provide, the stronger your position will be. Your inventory is your opening argument, so make it a powerful one.

What Happens If I Forget to List Something?

It happens. In the chaos after a fire or flood, it’s almost a guarantee you'll forget something. While your inventory is your absolute best tool, most policies have ways to handle missed items. It just gets a lot harder.

You'll be forced to rely on memory and scramble for proof after the fact. Think digging through old bank statements or asking friends for photos taken in your home that might, just maybe, show the item in the background. This is the exact stressful, time-sucking nightmare an inventory is designed to prevent.

Treat your inventory like a living document. The more you keep it updated, the smaller the chance you’ll overlook something important when it matters. An item you add to your list in two minutes today could save you hours of headaches and potentially thousands of dollars down the road.

Creating a complete home inventory can feel like a huge project, but Vorby makes it simple with AI-powered tools that do the heavy lifting for you. Our app uses image recognition to identify your items, parses email receipts to automatically log new purchases, and provides secure cloud storage so your inventory is always safe and accessible. Stop worrying and start documenting. Explore how Vorby can protect your belongings by visiting https://vorby.com and starting your free trial today.